This Week in Africa Finance- 111223

Plus Senegal is to start its first sustainable financing, Ghana's Koa gets new funding, Societe Generale is to sell its two operations in Mozambique and Burkina Faso and other notable deals. First time reading? Subscribe here

As always, please send us feedback at info@africafinancereview.co

Sustainable Finance

Senegal Receives €400 Million to Start First Sustainable Financing.

Senegal wants to increase its green and social investments with a €400 million partial credit guarantee facility from the Africa Development Bank (ADB). The new investment will be used to fund sustainable projects across the country.

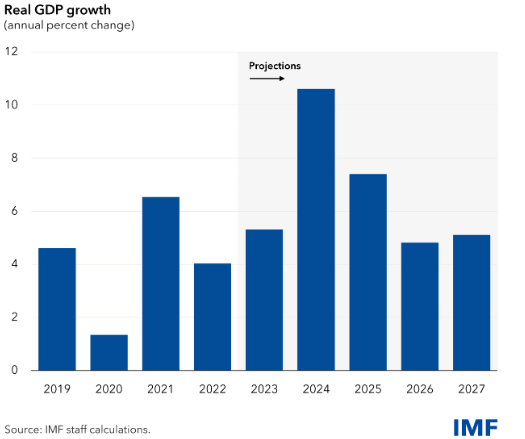

Why is this important: Senegal is one of the fastest-growing economies in sub-Saharan Africa with a GDP of 4.7 per cent in 2022 which is expected to grow to 5.3 per cent in 2023 due to its fast-growing oil and gas industry. The country has adopted a new national policy for economic and social development based on broad guidelines that focus on the effects of climate change and the principles of sustainable development.

This will be Senegal's first sustainable financing exclusively for green and social investments using its Sustainable Financing Framework published in June 2023, The framework includes international best practices for the selection, evaluation and monitoring of sustainable projects across key sectors such as social protection; water and sanitation; health; education; employment and financial inclusion.

The bottom line: International financing challenges and current economic headwinds have resulted in costly interest payments on sovereign loans taken by African countries. Senegal's financing agreement with the Africa Development Bank is unique as it guarantees protection against losses resulting from the country’s inability to pay principal and interest on the loan of up to €400 million.

Exits

Societe Generale exits its Mozambique and Burkina Faso Banking Operations.

Societe Generale the Paris-based multinational financial services provider is set to sell its two subsidiaries in Mozambique and Burkina Faso to Vista Group a pan-Africa banking group for an undisclosed amount subject to regulatory approval.

Why is this important: The exit from these two countries is part of Societe Generale's strategy to focus its resources on markets where it can be a market leader. The plans to sell its 52.6% and 65% holdings respectively in Société Générale Burkina Faso and Banco Société Générale, Mozambique, follows previous sales of its banking subsidiaries in Congo, Equatorial Guinea, Mauritania and Chad.

The bottom line: Societe Generale has always had a strong presence in Africa, However, the African banking sector is undergoing significant changes due to government regulations and the growing force of Fintech and Non-Banking start-ups. The competitive nature of the industry will see more mergers and acquisitions as players try to revisit their operating strategy to achieve profitability.

Trade Finance

Nigeria's FSDH Merchant Bank Secures US $20 Million Trade Finance Facility.

FSDH Merchant Bank has signed a $20 million trade finance facility with Africa Development Bank(ADB), which consists of a $15 million Trade Finance Line of Credit and a $5 million Transaction Guarantee that will be used to support small- and medium-sized businesses in Nigeria's industrial and manufacturing sectors.

Infrastructure

Emerging Africa Infrastructure Fund (EAIF) invests US $19 million in Uganda's New Solar Project.

The Emerging Africa Infrastructure Fund (EAIF) a Private Infrastructure Development Group (PIDG) company is to commit US $19 million to a new north-western Uganda 20MW solar PV project. The project will provide clean, affordable energy for one of the most remote and underserved regions in the country.

Other Notable Deals

M & A

- Beltone Financial the Egypt-based financial services provider intends to acquire Sodic Securitization, a subsidiary of SODIC, as it diversifies into non-banking financial services. The acquisition will be subject to the pending regulatory approvals.

Islamic Finance

- Nigeria's Islamic finance sector grew to US $2.9 billion as of the end of 2022 with Sukuk driving 57 per cent of the sector, Islamic banks accounting for 42 per cent and the remaining one per cent split between Islamic funds and takaful.

Private Credit

- BasiGo the e-mobility startup has secured a US$5 million debt facility from UK's development finance firm British International Investment (BII). The new funding will be used to produce more locally manufactured electric buses.

Venture Capital

- Koa the Swiss-Ghanaian coca processing start-up has secured US$15M in Series B funding to expand its cocoa fruit upcycling and shift to regenerative and climate-smart agriculture. The new funding round was led by the Land Degradation Neutrality (LDN) Fund from global asset manager Mirova, who injected $9M as an existing investor.

- Tappi an end-to-end digital commerce start-up has raised $1.5M in an oversubscribed Pre-Seed round led by Mercy Corps Ventures and Chui Ventures.

Thanks for reading the Africa Finance. Please send us your feedback, news or suggestions to info@africafinancereview.com.