Africa Private Capital Markets: Regional Hotspots and Business Sector Growth.

Not many African Conglomerates have grown to dominate their local and regional markets without engaging the public capital market for financing. Though this trend continues, the maturation of Africa’s private capital markets has grown over the last two decades, with more financing opportunities to companies at varying stages of development from start-ups to high-growth companies. This is reflected in increased deal activity across key sectors and regions.

Regional hotspots shaping up

Across the continent, investment deals have increased even with the global economic headwinds. West Africa remains the leading region with a significant inflow of private capital deals. According to the Africa Private Capital Association (AVCA), 31% of investments are concentrated in Nigeria, the largest economy in Africa with a vibrant tech ecosystem and accounting for 538 deals with a total value of $8.1 billion. The South African region had 438 deals with a total value of $5.1 billion. Interestingly, North America had fewer deal volumes but a total value of $1 billion less than the South African regional value of $4.9 billion.

Financial Services remain the central theme

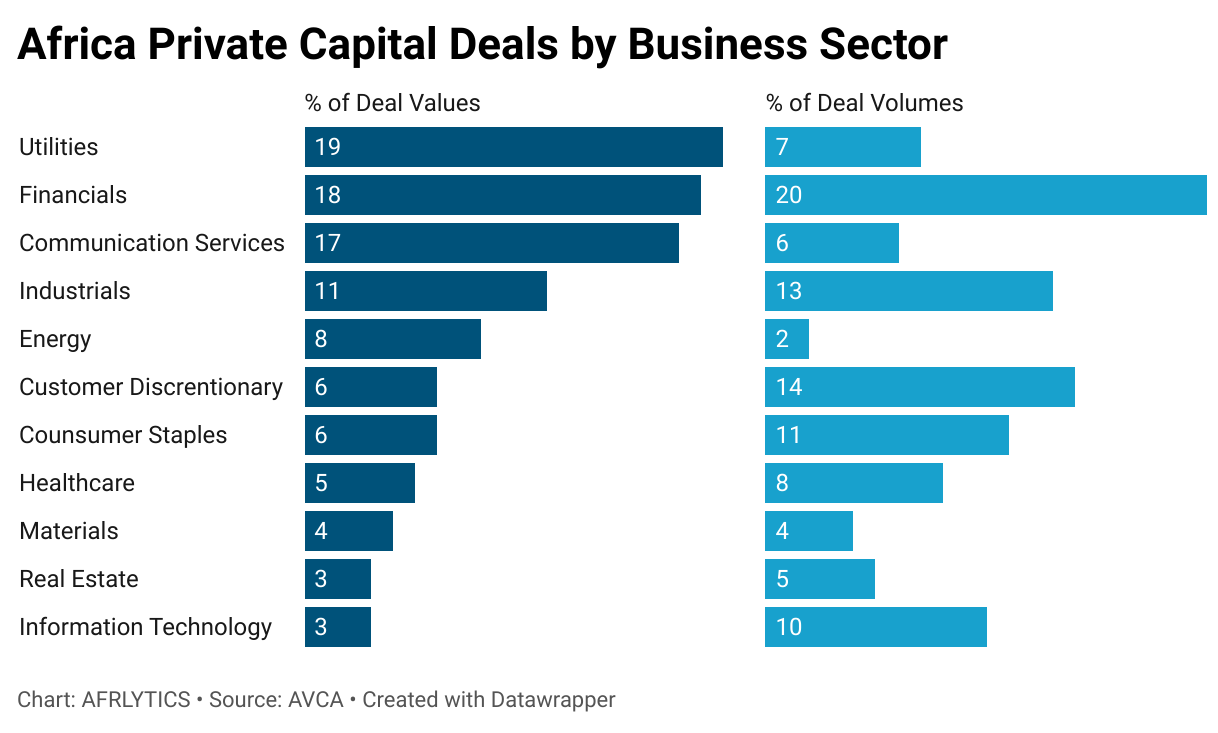

Across Africa, companies are looking to challenge the status quo of incumbents and offer new services and products to a growing and demanding customer base. This is more evident in the financial services industry where largely fintech companies are offering deeper and broader financial solutions considering Africa’s highly competitive and well-capitalised banking system. The popularity of this sector is reflected in the per cent of deal volume and values compared to other sectors.

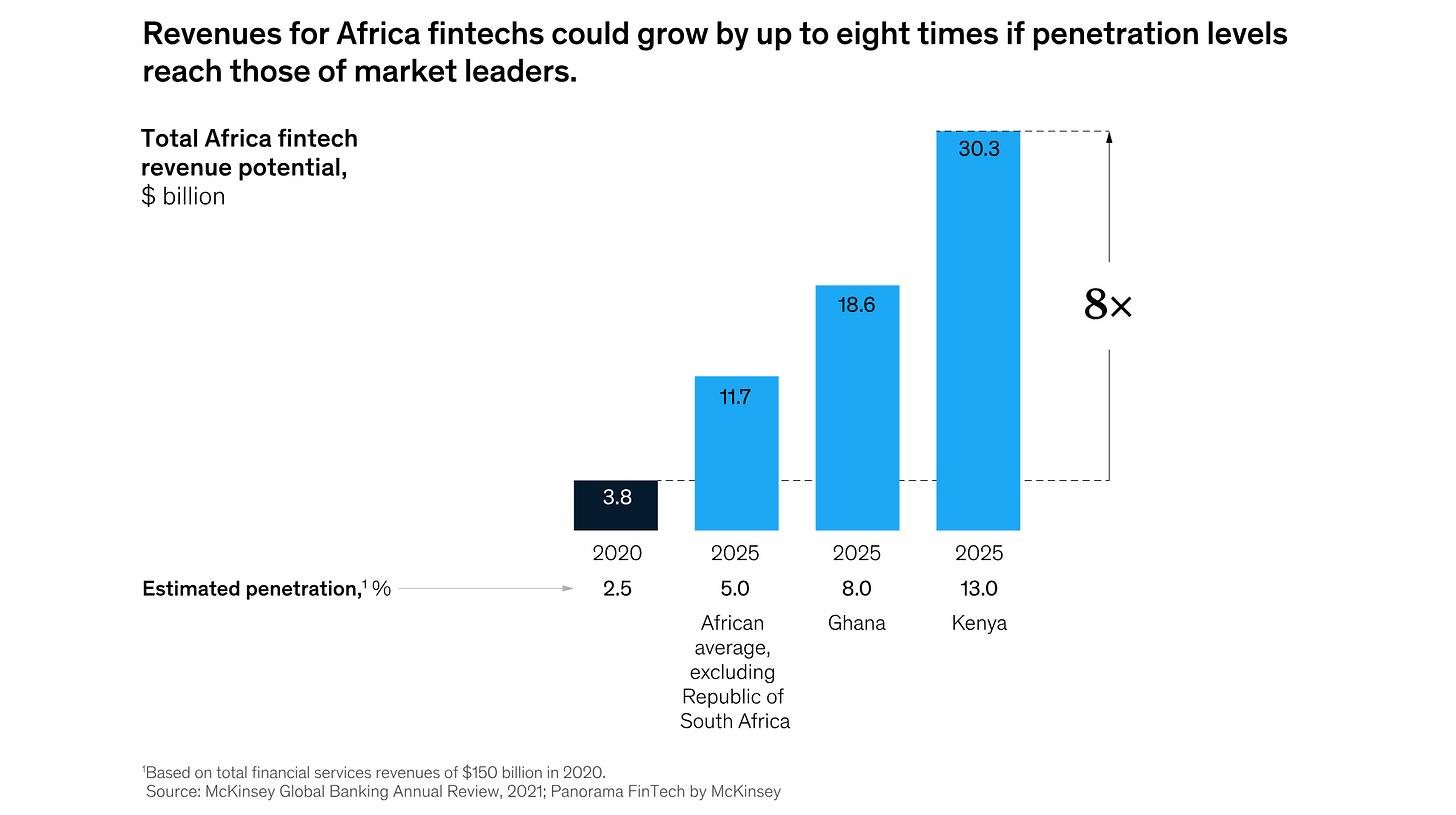

As these financial services companies look to continue to raise more private capital, their positioning and revenue are increasing. According to ‘McKinsey & Company’s ‘Fintech in Africa 2022, the revenue of African fintech is estimated to reach eight times its current value by 2025.