This Week in Africa Finance-271123

Islamic Banking in Egypt shows impressive growth, AfricaGoGreen raises $150m, South Africa issues new $1.1 billion Sukuk Bond, IFU invests €21 million in Morocco-based Healthcare provider, Banking Updates and Notable deals of the week.

Sustainable Finance

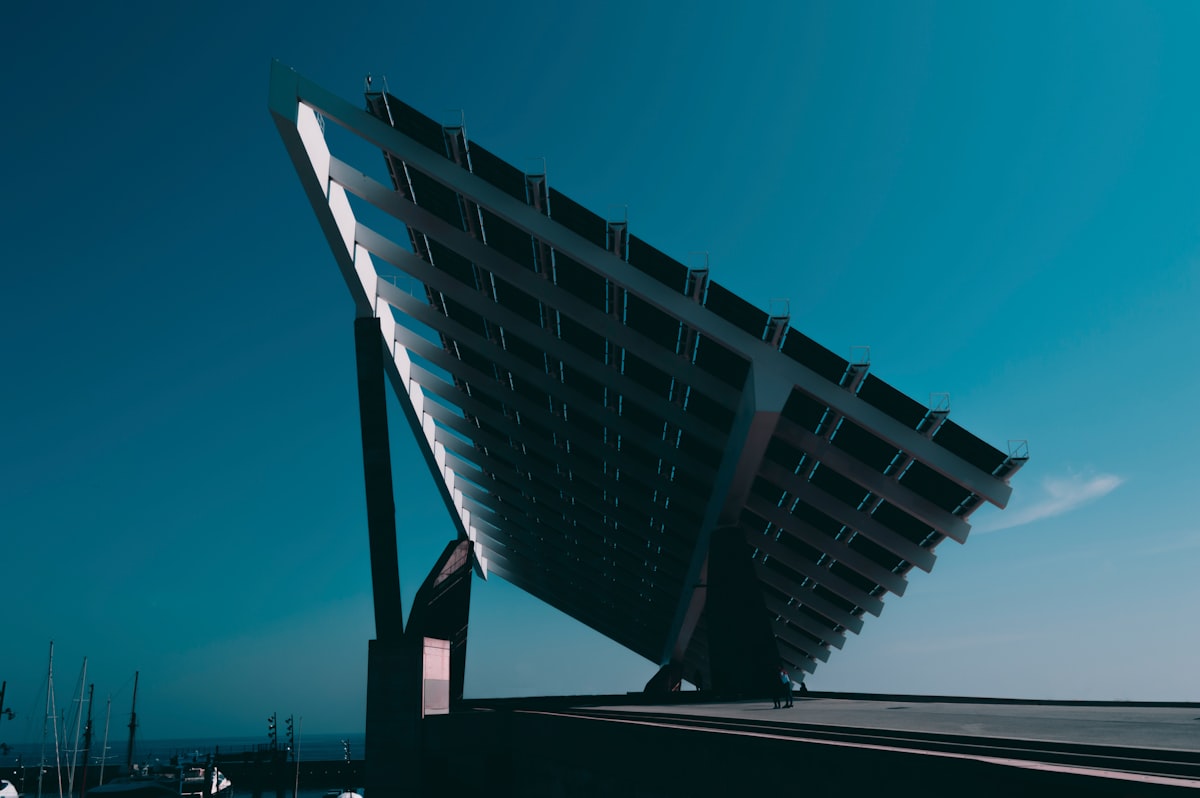

AfricaGoGreen Fund completes interim close of $150m.

AfricaGoGreen Fund AGGF a Fund initiated by KFW on behalf of the German government to advance climate resilience in Africa and the first structured debt fund in Africa focused on energy efficiency solutions has completed an interim close of $150m AUM.

Why it matters: The continent continues to face challenges in providing sustainable energy to its citizens, with over 640 million Africans not having constant electricity.

And the numbers: According to the Africa Development Bank, Africa needs US$288bn to reach the goal of universal access to electricity by 2030, requiring public and private, local and international partnerships to achieve this. The fund has a target size of £230-250m, with the latest funding rounds reflecting the commitment to investing in green energy in Africa. The latest $12m investment comes from the Clean Technology Fund of the Climate Investment Funds.

The bottom line: Public and private, local and international partnerships are needed to achieve sustainable energy supply and efficiency across the continent

Economy

- The Bank of Zambia in tackling the country's growing inflation by bringing it within the 6 per cent to 8 per cent target band has increased its key interest rate by 100 basis points to 11.

- Rwanda's Central Bank- The National Bank of Rwanda has kept its interest rate unchanged at 7.5 per cent as it targets the headline inflation to fall below 8 per by next year.

Banking Essentials:

- I & M Bank Rwanda has recorded a 7 per cent increase in pre-tax profit of RWF 10.9 billion ( approximately $ 8.8 million) in the third quarter of 2023 compared to the same period in 2022.

- Leading African Bank Access Bank is finalising plans to open a banking service in Asia in the first quarter of 2024. This would be subject to the necessary regulatory process.

- Islamic Banking in Egypt has grown by 27 per cent according to the Egyptian Islamic Finance Association. The industry recorded EGP 562 billion (approximately $18.2 million) in September 2023, reflective of 5 per cent of the Egyptian banking market and a 27 per cent increase of EGP 120 billion (approximately $ 3.9 billion) compared to September 2022.

Bonds

- The South African government issued its first Islamic bond since a debut sukuk in 2014. The 20.4 billion rand ($1.1 billion) sukuk is split into four tranches maturing between March 2029 and March 2036 and with rates of between 9.87% and 11.9%. The benchmark sovereign bond maturing in 2030 currently has a yield of 10.1%.

Fundraising

- Francophone Africa-focused VC firm Saviu Ventures has made an initial close of €12 million for its second fund at between €30 million and €50 million. The fund which received commitments from Kenyan and French family offices and other investors will invest in mainly Francophone Africa.

- The International Finance Corporation (IFC) is considering an equity investment of up to $30m alongside a co-investment envelope of up to US$20m into SPE PEF III, LP (SPE III, the Fund), managed by SPE Capital a fund targeting US$350m (hard cap of US$400m), to pursue control-oriented growth stage investments in North Africa.

Private Credit

- Kenya's leading non-banking financial firm Ed Partners Africa has announced a commitment of a $10 million loan guarantee facility from the United States' Development Finance Corporation (DFC) to expand its service of providing loans to affordable private schools.

- Nigeria's WEMA Bank Plc has received a $50 million loan facility from The ECOWAS Bank for Investment and Development (EBID). The new facility will be used to support Nigeria's growing agro-industry.

- Danish Impact Investor - The Investment Fund for Developing Countries IFU has invested €21 million in Morocco-based Oncologie et Diagnostic du Maroc (ODM) a leading healthcare provider in the country. The new investment will enable ODM to diversify its product offering and expand its existing network.

- Finnfund the Finnish development financier has invested €2 million (R39.9 million) in South Africa-based telco Fibertime Group a provider of fast, uncapped and time-based open-access fibre internet to townships.

Venture Capital

- Aquarech the Kenya fish farming startup has raised $1.7 million in equity investment to improve services to Kenya-based small-scale fish farmers through its mobile app platform.

- Beyond Capital a Venture Capital firm has made an investment in pan-Africa eyecare company Lapaire.

- Nigeria-based Aduna Capital has announced a $ 20 million fund to support start-ups based in Northern Nigeria.

- Nigeria-based trade finance startup FrontEdge has secured a $10 million in debt and equity funding round led by TLG Capital and other investors including Flexport. The new funding will be used to facilitate cross-border trade across Africa.

Private Equity

- Two leading Private Equity firms Africa50 and AfricInvest and Tokyo-based Ohara Pharmaceutical Co Ltd have invested $20 million in equity and debt in Africa Healthcare Network (AHN), a leading provider of dialysis services in Africa.

Thanks for reading the Africa Finance. Please send us your feedback, news or suggestions to info@africafinancereview.com. Please ask your friends and colleagues to subscribe.