This Week in Africa Finance -191223

Key Takeaways: Standard Chartered to exit Ivory Coast, Rwanda receives $268 million after IMF second review, Ghana tackles inflation and notable deals.

Banking

Standard Chartered To Sells Ivory Coast Banking Operation.

Standard Chartered, the international banking company is selling its consumer-banking business unit in Africa to Burkina Faso-based Coris Bank International subject to regulatory approvals as reported by Bloomberg. This follows the bank's sale of its business operations in Zimbabwe, Lebanon, Angola, Cameroon, Gambia, Sierra Leone, Jordan and Tanzania.

Why is it important: Standard Chartered has also had a long presence across Africa. The Bank is implementing a wider global strategy aimed at driving scale and operational efficiencies through the sale of its Sub-Saharan Africa banking operations. This would allow it to focus on areas of significant growth in other markets.

The bottom line: The sale of its banking operations is an opportunity for other African banks looking to expand their footprint across the continent to offer innovative banking solutions. Nigeria’s Access Bank took advantage of such an opportunity earlier this year by acquiring Standard Chartered's Gambia and Sierra Leone operations for an undisclosed sum.

Bonds

Tanzania's NMB Bank Launches $400 Million Dual-Currency Sustainability Bonds.

NMB Bank Tanzania's leading commercial bank has raised $400 million from the issuance of dual-currency sustainability bonds. The Bank is a leader in innovative financial products such as sub-Saharan Africa's first Gender Bond listed in 2022 and targeted at women-owned micro, small and medium-sized businesses.

Why is it important: The sustainability bonds in the form of Tanzanian shilling and U.S. Dollar-denominated portions will fund climate, social and environment-focused projects using the country's natural resources. Due to the importance of the issuance, The International Finance Corporation (IFC ) subscribed to almost 16 per cent of the Tanzanian shilling and U.S. Dollar-denominated tranches of the multi-currency bond.

The bottom line: African nations are pushing for a growing share of funding for ESG-focused projects. The funding and implementation of these sustainability projects need to include the necessary regulatory framework, monitoring structure and data to instil confidence in investors and show them a path to return on their investment.

Sovereign Debt

Rwanda Receives $268Million Credit Facility after IMF's Second Review.

The International Monetary Fund (IMF) has concluded a second review of both Rwanda's Policy Coordination Instrument (PCI) a non-financing instrument open to all IMF member countries and the arrangement under the Resilience and Sustainability Facility (RSF) an affordable long-term financing to countries undertaking reforms to reduce risks to prospective balance of payments stability. The completion of the review process has led to the approval of a new 14-month Stand-by Credit Facility arrangement.

Why is this important: Economic headwinds, rising interest rates and global financial constraints are affecting Rwanda's economic performance with a growth rate down from 8.2 per cent in 2022 to 6.2 per cent in 2023, The country is still undergoing strong fiscal, monetary and exchange rate reforms to grow the economy. The Board's approval will allow for the immediate disbursement of $ 49.49 million under the RSF and $89.35 million under the SCF.

The bottom line: Considered one of the economic successes of Africa, Rwanda's growth is reflected in its political stability, economic and structural reforms and a strong emphasis on infrastructure investments. According to the World Bank, the country's goal is to achieve a middle-income country status by 2035 and a high-income country status by 2050, with consistent implementation of its reforms it is certainly achievable.

Economy

Ghana Achieves Record Drop in Inflation Rate.

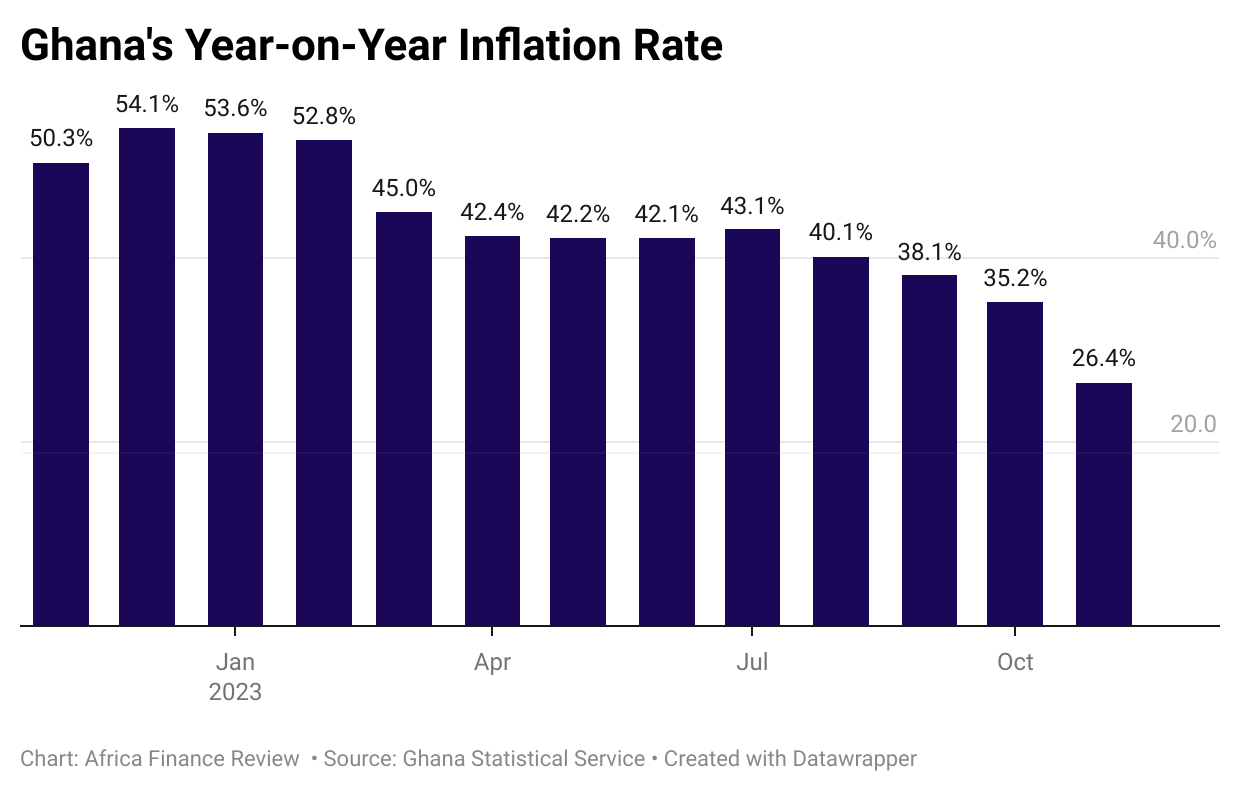

Ghana has recorded a record 19-month low in November's inflation rate, a rare feat for any African nation.

Why is this important: The gradual reduction in the overall inflation rate to 26.4% in November 2023 compared to 35.2% in October 2023 is due to a sustained monetary policy by the Bank of Ghana aimed at inflation targeting using its monetary policy rate (MPR) which remains unchanged at 30% since September 2023.

The bottom line: The implementation of Ghana's monetary policy is yielding progress through strong economic growth and a stabilised exchange rate. The country continues to make strides to restructure its $20 billion of external debt, including bilateral debt, export credit agencies-backed commercial loans, Eurobonds and non-insured commercial loans, under the G20 Common Framework.

Fundraising

- Aqua-Sparks Africa, Aqua-Spark's subsidiary fund for the African continent has secured a €15 million (USD 16.18 million) commitment from The German Federal Ministry for Economic Cooperation and Development (BMZ), through KfW - its state-owned investment and development bank. It will also provide a technical assistance grant of EUR 1 million (USD 1.07 million).

- EduFund -The Education Investment Impact Fund of South Africa (EduFund), managed by Old Mutual Alternative Investments (OMAI), has completed its second close at ZAR825 million (c. $44.4 million).

- E4E Africa The South Africa-based venture capital fund, has announced the first close of its US$30 million E4E Africa Fund II.

Private Equity

- British International Investment BII the UK's development finance institution and impact investor, has announced a $15 million commitment to Valency International which will help to boost food security and job creation in Nigeria.

Thanks for reading the Africa Finance. Please send us your feedback, news or suggestions to info@africafinancereview.com.