Africa's $56 Billion Remittance Market Needs a Fintech Disruption

Remittances, the cross-border payments used by the African diaspora community to send money back home to their families and loved ones need disruption by our Fintech heroes.

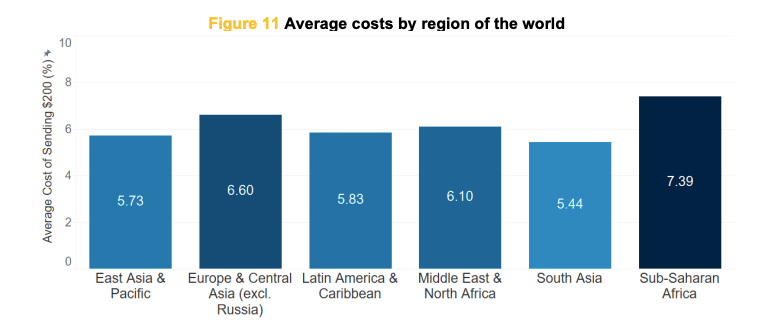

Over 20 million Africans have migrated outside the continent to mostly Europe, North America and Asia in the last two decades based on data from the Africa Development Bank (ADB). The migration has resulted in more remittances being sent back home but at a high processing cost, which should be passed to the recipient. According to the World Bank’s Remittance Prices Worldwide (RPW) database, the global average cost of sending $200 was 6.2 per cent in 2023 Q2, notably Sub-Saharan Africa is the most expensive region at 7.39% per average cost of remittance services. The United Nations is keen to reduce the cost to less than 3% of the remittance by 2030 as part of its Sustainable Development Goals.

The demand for mobile money services in Sub-Saharan Africa is growing leading to more competition as new Fintech entrants offer innovative solutions. Even with the changing dynamics, the cost of remittance transfer remains high, due to unfavourable government policies like remittance taxes introduced in Tanzania, Nigeria's suspension of money transfer operations in addressing the currency crises in 2023, expensive remittance corridors and low financial footprint in rural areas for the unbanked.

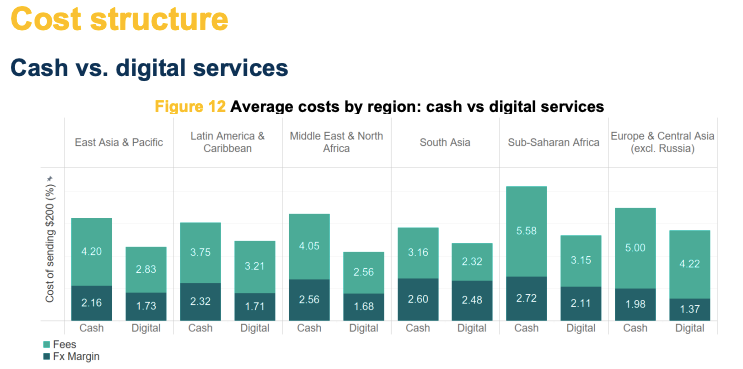

Most African economies are cash-driven hence a strong preference for cash transfers instead of digital transfers, but in today's market, they come with high fees. The recipient of a remittance is faced with two cost components: fee and foreign exchange margin. Sub-Saharan Africa has the highest charges for sending cash transfers compared to digital transfers regardless of the region where the money is being sent.

The bottom line: The prospect of digital transfer offering better cost per remittance presents an opportunity for Fintech startups considering the demand for these services and the Telcos have started to take full advantage. MTN, Africa's largest telecommunication company announced last year the expansion of their Fintech capabilities to include remittance services targeting the 15% of unbanked South Africans. Due to its continent-wide footprint, the company is offering the same platform to recipients in 10 other African countries. Creating fintech solutions that increase the dependency on digital remittance directly to bank accounts with transparency of services and cost has its social-economic benefits. Our Fintech heroes can learn from other players like Wise who have actively reduced the cost of sending money through their remittance services.